After several subdued years, the Vietnam National Textile and Garment Group (Vinatex, UPCoM: VGT) recorded a strong rebound in profit in 2025, while also far exceeding its set targets.

By the end of 2025, Vinatex reported pre-tax profit of VND 1,479 billion, up 77% from the previous year; net profit reached nearly VND 873 billion, surging 169%. Compared with its previous record in 2021—pre-tax profit of VND 1,456 billion and net profit of VND 803 billion—the 2025 results were higher across the board, indicating that Vinatex has not only recovered but also established a new growth trajectory after a prolonged difficult period.

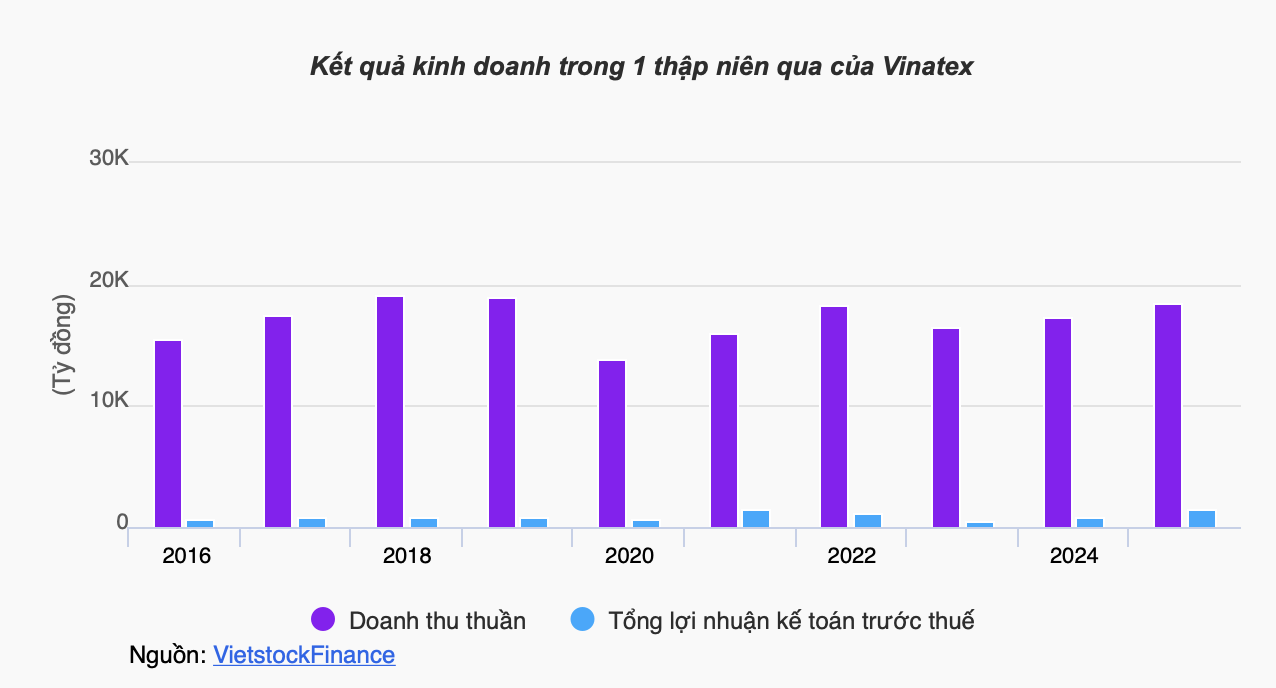

Net revenue came in at nearly VND 18,400 billion (equivalent to over USD 700 million), increasing by more than VND 1,000 billion (+6%) year on year. This was the highest revenue level in the past six years, approaching the over-VND 19,000 billion range achieved in 2018–2019. Alongside revenue growth, the gross profit margin improved markedly to nearly 13%, up from 10.8% in 2024.

Against the 2025 plan, Vinatex slightly exceeded the revenue target of over VND 18,300 billion, and far surpassed the pre-tax profit target of VND 910 billion—beating it by as much as 62.5%.

Q4: Revenue slowed, but profit hit a new peak

Vinatex said its improved 2025 performance was driven by many customers accelerating shipments in the first nine months of the year to avoid tariff-related risks. As a result, deliveries in the final quarter declined, with Q4 revenue slipping nearly 3% year on year to just over VND 4,600 billion.

Even so, Q4 made a strong contribution to the full-year results as net profit reached VND 294.5 billion—the highest level in 14 quarters—up 93% from the same period last year. This was supported by a sharp improvement in gross margin from 11.5% to 13%, along with a 43% cut in financial expenses, which helped offset a roughly 12% decline in financial income.

The strong earnings news was quickly reflected in VGT’s stock performance. In the morning session of January 29, VGT shares jumped nearly 4% to VND 13,300 per share, bringing the stock’s one-month gain to over 8%.

However, on a one-year basis, VGT’s share price was still down slightly by about 2%. Trading liquidity remained steady at an average of over 1.2 million shares per session.

Assets surpass VND 20 trillion; equity tops VND 10 trillion for the first time

By the end of 2025, Vinatex’s total assets exceeded VND 20 trillion, reaching VND 20,584 billion, up more than VND 1,300 billion (around 7%) from the beginning of the year. Within the asset structure, bank deposits rose sharply to nearly VND 4,166 billion, accounting for over 20% of total assets—up nearly 20% (about VND 700 billion) compared with the start of the year.

Inventories were recorded at over VND 3,491 billion, up 8% and making up nearly 17% of total assets. Of this, raw materials accounted for more than one-third, while finished goods represented about 17%.

On the other hand, Vinatex’s total outstanding borrowings came to nearly VND 6,779 billion, up almost 6%; short-term loans made up 72%, equivalent to more than VND 4,908 billion. In 2025, interest expenses were recorded at over VND 332 billion, down slightly 2% from the previous year—meaning the company spent an average of about VND 909 million per day on interest payments.

At the same time, undistributed post-tax profits surged to more than VND 1,420 billion, up 58% from the beginning of the year. Shareholders’ equity surpassed VND 10 trillion for the first time, reaching VND 10,026 billion, strengthening the company’s financial foundation after a year of exceptional growth.